Much more than billing, our goals seek to reconnect commercial relationships, deliver effective results and solve the needs of our clients in all sectors and at all times.

- Institutional video

Financial cycle

and credit

Reconnects business relationships

Preventive Solutions

Through BI data, contractors will have access to the credit score that indicates the probability of the individual becoming a defaulter. A fundamental strategy for granting credit and preventing default.

It allows the contractor to plan, together with the WB team (e-negotiator, massive actions, identification of reasons for default, reinforcement of bills and monitoring), analyze the defaulter's profile and reduce the receivables cycle.

Used 15 days before the due date, with personalized billing, email and SMS actions aimed at payment within pre-established deadlines and maintaining the relationship.

Resolute Solutions

Extrajudicial collection begins strategically after 31 days of delay, with teams of negotiators seeking the best solutions for settlement, according to the average ticket and customer and product profile, reducing the term of receivables, optimizing the resumption of business and avoiding wear and tear and losses for our customers.

When attempts at amicable negotiation fail, the WBLEGAL team takes action to recover credit through legal strategies. These efforts are fueled by in-depth analysis of documents, information and records, aiming to recover receivables in the shortest possible time.

We work with specialized cells, focused on different audience segmentations, profiles, tickets and pre-legal strategies, in addition to special actions that guarantee personalized performance for each situation, whether delicate or incisive, with the “CERTAIN CERCA APJ NAJD” approach.

Solutions Preventive

Through BI data, contractors will have access to the credit score that indicates the probability of the individual becoming a defaulter. A fundamental strategy for granting credit and preventing default.

It allows the contractor to plan together with the WB team (e-negotiator, massive actions, reasons for default, payment slip reinforcements and monitoring), analyze the defaulter's profile and shorten their receivables cycle.

Used 15 days before the due date, with personalized billing, email and SMS actions aimed at payment within pre-established deadlines and maintaining the relationship.

Solutions Resolutive

Extrajudicial collection begins strategically after 31 days of delay, with teams of negotiators seeking the best solutions for settlement, according to the average ticket and customer and product profile, reducing the term of receivables, optimizing the resumption of business and avoiding wear and tear and losses for our customers.

When attempts at amicable negotiation fail, the WBLEGAL team takes action to recover credit through legal strategies. These efforts are fueled by in-depth analysis of documents, information and records, aiming to recover receivables in the shortest possible time.

We work with cells focused on the differentiation of audience, profile, ticket, pre-legal strategies and special actions that provide performance according to each situation, whether delicate or incisive CERCA CERTA APJ NAJD

WB FINANCE

Extrajudicial

Judicial

Credit Insurance

Prevention

Tools Used

We use tools that provide ease and agility in negotiations.

Calls

SMS

Social media

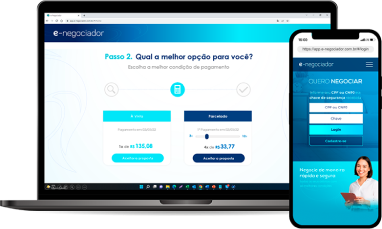

Auto-Trading Portal

Trade in 1 click, quickly and easily with

e-negotiator! Discover our complete auto-negotiation platform